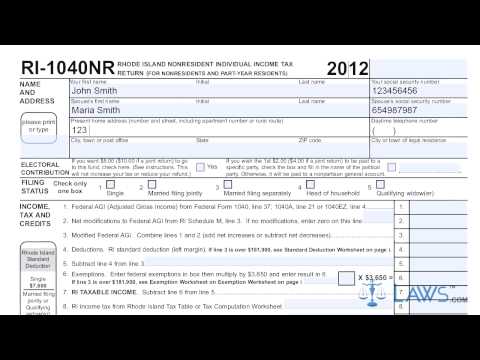

Laws.com provides a legal forms guide for various forms, including the 110 40 form and the non-resident individual income tax return for Rhode Island. This form is used by non-residents and part-year residents who owe tax on income earned in the state. To file their state income tax, individuals can find the form on the website of the Rhode Island Division of Taxation. Here are the steps to complete the form: 1. Start by providing your name, address, and social security number at the top of the page. If filing jointly with your spouse, include their name and social security number as well. 2. Check the to indicate whether you want an electoral contribution to be made. 3. Use a check mark to indicate your filing status. 4. Add your adjusted federal gross income on line 1. To determine your adjustments, complete the separate schedule M form and enter the values on line 2. Add lines 1 and 2, and enter the sum on line 3. 5. Consult the chart on the left to determine your standard deduction. Enter this value on line 4. Subtract this value from line 3 and enter the difference on line 5. 6. Multiply all federal exemptions by $3,500 and enter the result on line 6. Subtract this value from line 6 and enter the difference on line 7. 7. Use the Rhode Island tax table or tax computation worksheet to calculate your state income tax. Enter the result on line 8. Complete schedule I on the second page to fill in line 9. Subtract line 9 from line 8 and enter the result on line 10. Follow the provided instructions to complete lines 11 through 15. 8. Document any tax payments already made on lines 17A through 17F. 9. Follow the instructions on lines 18 through 21 to determine the amount you owe or...

Award-winning PDF software

1040nr 2025 Form: What You Should Know

Instructions for Form RI-1040NR — RI Division of Taxation 2018. RI-1040NR Form RI-1040NR, Rhode Island Individual Income Tax Return. Form RI-1040NR. RI Division of Taxation. 2018. RI-1040NR Form RI-1040NR — RI Division of Taxation If you are filing a Rhode Island individual income tax return, submit the following information: Individual Income Tax Return Date of birth (if different from the date of filing) Social Security Number Payroll and Other Wage and Tax Information If the only income was from scholarships, attach a statement of the awards and amounts received Form 940, Employer's Tax Return If you were an employee and received wages subject to U.S. income tax withholding, submit Form 940. Form 940 with W-2 or 1099G (if you are filing electronically) 2017. Instructions for Form 940 (PDF) 2018 Form 940. Employer's Tax Return. Form 940. U.S. Nonresident Alien Individual (Individuals and corporations) and the self-employed, including sole proprietorship (S) and partnerships (P) with one or more partners. (Maybe combined with other forms of return.) Department of the Treasury. Internal Revenue Service. 2018. Instructions for Form 940 (PDF) Form 940NR. 2018. (Rev. April 2020). U.S. Nonresident Alien Income Tax Return. IRS. You will have to enter 1030NR on line 7 (see Schedule A, “Form 940, Employer's Tax Return.”) Individual Income Tax Return Individual. 1032 (PDF) Individual with dependents. 1032.1-2 (PDF, 652 KB) Family and other nonresident aliens. 1032.1-2A (PDF, 666 KB) Form 940NR. (Rev. April 2020.) U.S. Nonresident Alien Income Tax Return. Department of the Treasury. (If you were an employee and the only income was from scholarships, attach a statement of the awards and amounts received.) Individual Income Tax Return Date of birth (if different from the date of filing) Social Security Number Payroll and Other Wage and Tax Information.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040-NR, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040-NR online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040-NR by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040-NR from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040nr 2025